Mena IPO records 16 deals in H1 2017

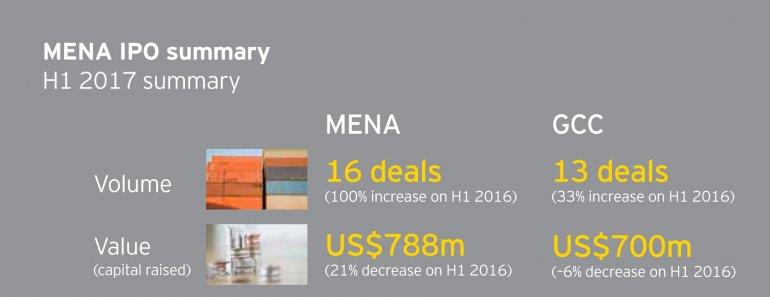

Mena IPO activity witnessed 16 deals, representing a 100 percent increase in the first half (H1) of 2017 when compared to the H1 2016. Announced Mena value, or capital raised, reached $788m in H1 2017, a 21 percent decrease from H1 2016. H1 2017 was the most active first half of the year by number of IPOs since H1 2007.

Out of the 16 IPOs, nine IPOs worth $200.5m were from companies listed on the Saudi NOMU market. The cross-border IPO of ADES International Holding Ltd. raised $243.5m on the London Stock Exchange and was the largest IPO of a MENA company, by capital raised, year-to-date.

Gregory Hughes, EY MENA IPO Leader, said: 'Increasing stability in oil prices and confidence in the global economy and markets are likely to drive an increased IPO activity in 2017 and 2018 across Mena, with a strong backlog of companies potentially preparing to come to market. The key driver for the Mena IPO market will likely be the privatization of leading government-owned assets across a number of sectors.

The greenfield IPO of Orient UNB Takaful PJSC (Orient UNB) in second quarter (Q2) of 2017 represents the first IPO on the Dubai Financial Market (DFM) since the IPO of Dubai Parks and Resorts in 2014.

The GCC saw 13 IPOs raised in H1 2017, a 33 percent increase on the deals announced for the same period last year. However, deal value declined by 6 percent to $700m in H1 2017 when compared to H1 2016.

The highest capital raised in H1 2017 was in the oil and gas sector with one deal announced at a value of $243.5m. The construction industry followed with one deal valued at $135m. The third most valuable IPO by capital raised was in the real estate investment trust (REIT) at $105m for one deal.

In H1 2017, oil prices continued to fluctuate between $45 and $55 per barrel as the initial effect of agreed oil production cuts by Opec and non-Opec members continue to be impacted by ongoing market factors, resulting in a downward trend toward the end of Q2 2017. However, the continued drive for privatization across Mena countries is likely to result in an increase in the number of IPOs on exchanges.

Mayur Pau, MENA Financial Services IPO Leader, EY, said:'Global IPO activity should continue to strengthen in the second half of 2017, underpinned by capital markets reaching all-time highs. Investor sentiment has improved and the global outlook is more positive, which should reflect on the IPO market in the Mena region.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment