403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Canadian crude proves perfect partner to US shale

(MENAFN- Gulf Times) US refineries are processing record quantities of heavy crude from Canada as the perfect complement to light oils from North Dakota and Texas as they struggle to keep their average blend steady.

Crudes vary enormously € from low-density oils with few impurities to much denser oils containing a relatively high percentage of sulphur and heavy metals such as nickel and vanadium.

Bakken and Eagle Ford are light, sweet oils, while Saudi Arabia's Arab Heavy and Alberta's Western Canadian Select are much heavier and sourer.

The density of crudes is normally expressed in terms of degrees API, which compares oil to the density of water at a standard temperature of 60 degrees Fahrenheit. Crude density ranges from 42 degrees API for Bakken (which makes it about 80% as dense as water at standard temperature) to 27 degrees for Arab Heavy (89% as dense as water) and 22 degrees for Western Canadian Select (93% as dense as water).

But the big differences are easier to understand by switching to more familiar units. A cubic metre of Bakken crude weighs around 815 kg, compared with 885 kg for Arab Heavy and 925 kg for Western Canadian Select.

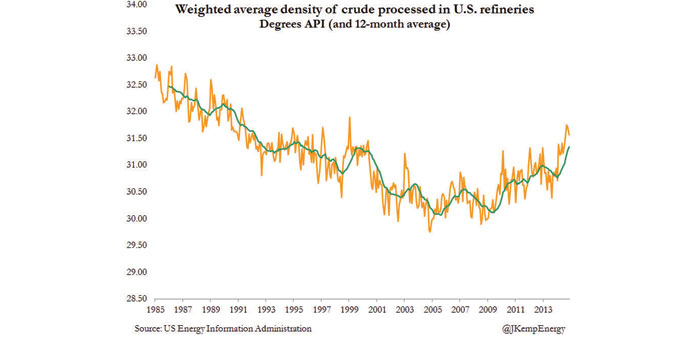

While the qualities of crudes vary widely, US refiners have discerning requirements. The average density of crude processed in US refineries has been steady, varying by only 3 degrees over the last three decades, or about 17 kg per cubic metre, according to the US Energy Information Administration (EIA).

US refiners like to process crudes averaging around 30-32 degrees API, or between 865 and 875 kg per cubic metre.

Refineries achieve this remarkably steady performance by blending crudes to achieve a combined feed as close as possible to the ideal.

Bakken, at just 815 kg per cubic metre, is much lighter than the 865-875 kg refineries are trying to achieve. Eagle Ford is lighter still. US refiners have responded to the rising output of very light domestic crudes by cutting back purchases of other light oils from abroad while importing more heavy crudes to keep the average density roughly constant.

Strict blending requirements explain why US imports of light oils from countries such as Nigeria have dwindled to almost nothing while refiners import record quantities of much heavier oil from Canada.

In fact, Western Canadian Select (WCS) is the perfect complement for shale oil production from the Bakken and Eagle Ford. WCS is around 55 kg per cubic metre heavier than refiners would like on average, while Bakken is around 55 kg too light, so they blend perfectly with one another.In practice, blending is slightly more complicated than this simple example. However, heavy crude oils from Alberta are the perfect blending partners for light crudes from the main shale plays in North Dakota and Texas. As a result, US imports from Canada reached almost 3mn barrels per day in the final months of 2014, up from less than 2mn bpd in 2010, according to the EIA.

President Barack Obama has implied that the proposed Keystone pipeline would be of little benefit to US refiners because it would carry Canadian crude across the US for export to foreign markets. "Understand what this project is," the president said during a November visit to Myanmar. "It is providing the ability of Canada to pump their oil, send it through our land, down to the Gulf, where it will be sold everywhere else."

The president was poorly briefed. US refineries are processing record volumes of Canadian oil, even as US production is rising, and they are hungry for more. Canadian oil is being processed together with US shale oil to enable US refineries to make best use of their equipment, which is why refiners support Keystone.

Without more imported Canadian oil, which could come via pipeline or on rail cars, refineries will have to turn to other suppliers of heavy crude. The prime candidates would be Venezuela, Saudi Arabia, Iraq and Mexico.

Quality issues also explain why there is a compelling case to permit more US domestic crude to be exported rather than refined at home. US refineries cannot simply refine more US production (weighing 815 kg per cubic metre) by replacing Canadian crude (weighing 925 kg).

Policymakers who suggest the US need not build pipelines from Canada, and should maintain restrictions on the export of domestic crude to promote national energy security, do not understand how refineries operate.

US refineries are already struggling to maintain their preferred blend in the face of a torrent of light oil from Bakken, Eagle Ford and the Permian Basin.

Even with rising Canadian imports, the average API gravity of crude processed at US refineries has risen from a recent low of 29.9 degrees in June 2008 to a high of 31.8 degrees in September 2014.

In the 12 months to September, average API gravity rose by almost a full point, which is an enormous shift in such a short time. In the short term, refineries have some operational flexibility. But the record suggests this flexibility is limited to changing the average crude mix by 2 or 3 degrees API at most.

US refineries cannot run on an exclusive diet of 40 degree shale oil without enormous and expensive investment in new equipment. Production from the major US shale plays is likely to flatten this year after growing by around 1mn barrels per day in both 2013 and 2014.

But if shale starts growing again in 2016 and 2017, it will need to be coupled with increased imports from Canada and a liberalisation of US export restrictions to avoid severe operational distortions in the US refining system.

John Kemp is a Reuters market analyst. The views expressed are his own.

Crudes vary enormously € from low-density oils with few impurities to much denser oils containing a relatively high percentage of sulphur and heavy metals such as nickel and vanadium.

Bakken and Eagle Ford are light, sweet oils, while Saudi Arabia's Arab Heavy and Alberta's Western Canadian Select are much heavier and sourer.

The density of crudes is normally expressed in terms of degrees API, which compares oil to the density of water at a standard temperature of 60 degrees Fahrenheit. Crude density ranges from 42 degrees API for Bakken (which makes it about 80% as dense as water at standard temperature) to 27 degrees for Arab Heavy (89% as dense as water) and 22 degrees for Western Canadian Select (93% as dense as water).

But the big differences are easier to understand by switching to more familiar units. A cubic metre of Bakken crude weighs around 815 kg, compared with 885 kg for Arab Heavy and 925 kg for Western Canadian Select.

While the qualities of crudes vary widely, US refiners have discerning requirements. The average density of crude processed in US refineries has been steady, varying by only 3 degrees over the last three decades, or about 17 kg per cubic metre, according to the US Energy Information Administration (EIA).

US refiners like to process crudes averaging around 30-32 degrees API, or between 865 and 875 kg per cubic metre.

Refineries achieve this remarkably steady performance by blending crudes to achieve a combined feed as close as possible to the ideal.

Bakken, at just 815 kg per cubic metre, is much lighter than the 865-875 kg refineries are trying to achieve. Eagle Ford is lighter still. US refiners have responded to the rising output of very light domestic crudes by cutting back purchases of other light oils from abroad while importing more heavy crudes to keep the average density roughly constant.

Strict blending requirements explain why US imports of light oils from countries such as Nigeria have dwindled to almost nothing while refiners import record quantities of much heavier oil from Canada.

In fact, Western Canadian Select (WCS) is the perfect complement for shale oil production from the Bakken and Eagle Ford. WCS is around 55 kg per cubic metre heavier than refiners would like on average, while Bakken is around 55 kg too light, so they blend perfectly with one another.In practice, blending is slightly more complicated than this simple example. However, heavy crude oils from Alberta are the perfect blending partners for light crudes from the main shale plays in North Dakota and Texas. As a result, US imports from Canada reached almost 3mn barrels per day in the final months of 2014, up from less than 2mn bpd in 2010, according to the EIA.

President Barack Obama has implied that the proposed Keystone pipeline would be of little benefit to US refiners because it would carry Canadian crude across the US for export to foreign markets. "Understand what this project is," the president said during a November visit to Myanmar. "It is providing the ability of Canada to pump their oil, send it through our land, down to the Gulf, where it will be sold everywhere else."

The president was poorly briefed. US refineries are processing record volumes of Canadian oil, even as US production is rising, and they are hungry for more. Canadian oil is being processed together with US shale oil to enable US refineries to make best use of their equipment, which is why refiners support Keystone.

Without more imported Canadian oil, which could come via pipeline or on rail cars, refineries will have to turn to other suppliers of heavy crude. The prime candidates would be Venezuela, Saudi Arabia, Iraq and Mexico.

Quality issues also explain why there is a compelling case to permit more US domestic crude to be exported rather than refined at home. US refineries cannot simply refine more US production (weighing 815 kg per cubic metre) by replacing Canadian crude (weighing 925 kg).

Policymakers who suggest the US need not build pipelines from Canada, and should maintain restrictions on the export of domestic crude to promote national energy security, do not understand how refineries operate.

US refineries are already struggling to maintain their preferred blend in the face of a torrent of light oil from Bakken, Eagle Ford and the Permian Basin.

Even with rising Canadian imports, the average API gravity of crude processed at US refineries has risen from a recent low of 29.9 degrees in June 2008 to a high of 31.8 degrees in September 2014.

In the 12 months to September, average API gravity rose by almost a full point, which is an enormous shift in such a short time. In the short term, refineries have some operational flexibility. But the record suggests this flexibility is limited to changing the average crude mix by 2 or 3 degrees API at most.

US refineries cannot run on an exclusive diet of 40 degree shale oil without enormous and expensive investment in new equipment. Production from the major US shale plays is likely to flatten this year after growing by around 1mn barrels per day in both 2013 and 2014.

But if shale starts growing again in 2016 and 2017, it will need to be coupled with increased imports from Canada and a liberalisation of US export restrictions to avoid severe operational distortions in the US refining system.

John Kemp is a Reuters market analyst. The views expressed are his own.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment