Emerging Markets In The Digital Age

My colleagues and I have been actively speaking about the evolution taking place in many emerging markets over the past few decades. We've seen dramatic shifts occurring, with the often one-dimensional economic models of the past giving way to new and diverse growth drivers. This evolution includes the rapid embrace of new technologies and the rapid digitalization of economies. Here, Carlos Hardenberg, senior vice president and managing director at Templeton Emerging Markets Group, further addresses the topic.

Get The Timeless Reading eBook in PDF Get the entire 10-part series on Timeless Reading in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

Also read:

Looking at emerging-market economies as a whole, we've seen a dramatic transformation from the models of the past, which were often based on commodity exports. We've seen a new generation of highly innovative companies located in emerging markets moving into higher value-added production processes and services. We think it's a very exciting time for investors in this space.

The technology sector in emerging markets is providing us with many interesting opportunities—from hardware to software to various forms of e-commerce and entertainment.

Autonomous driving is an example of the growing clout of emerging-market companies. Many producers of the components and infrastructure to make autonomous driving a reality are located in emerging markets, particularly in Asia. And, they are highly specialized. For example, sensors, cameras, other lightweight components and software to enable autonomous driving are oftentimes produced in emerging markets.

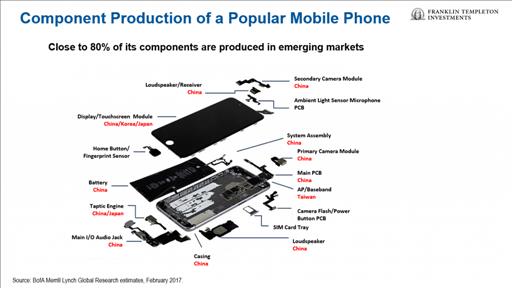

Another example is in mobile-phone technology. Some 80% of the components of one popular mobile phone are made in emerging markets, from the battery to the camera to the casing (see image below).

We know how technology has touched nearly every aspect of our lives. It has transformed how we communicate with each other, how we shop, work and play. This is true for consumers across the globe, even in what one might consider the least-developed economies. It has been estimated that 40-50% of the world's population has access to the internet, and 70% of youth aged 15-24 use it. It wasn't all that long ago that no one did.

The number of internet users has increased tenfold from 1999 to 2013. The first billion was reached in 2005, the second billion in 2010 and the third billion in 2014. When looking at the amount of internet users globally, China (21%) and India (14%) have the largest share, above the United States (9%), Japan (3%) and Germany (2%).

China's 'Internet Plus' strategy, unveiled in 2015, demonstrates the key role the government hopes online businesses will play in fueling its next stage of economic growth. The strategy aims to increase digitalization across the economy and to increase the presence of China's internet-based businesses globally.

Many members of this new generation of 'digitalized' consumers (including those in emerging markets) have probably never visited a physical bank branch, have never used a telephone tethered to a cord and are increasingly shunning brick-and-mortar stores to buy clothes and other wares online.

This increasing internet access means increasing opportunities. Take Indonesia, for example. Research from the International Telecommunications Union has found for each 1% increase in the internet penetration rate, unemployment growth would be reduced by 8.61%. The entire effect of broadband on unemployment is a combination of new jobs and existing jobs saved that otherwise would have contributed to the unemployment rate.

In turn, consumers have more discretionary income, and the middle class is able to gain more clout. This increased spending power has driven a more consumer-oriented culture, and new and more diverse investment opportunities.

According to McKinsey research, if Indonesia fully embraces digitization, it can realize an estimated USD $150 billion in growth—10% of GDP—by 2025. Harnessing digital technology can boost productivity and expand economic participation across the economy. While e-commerce is growing rapidly in Indonesia—one of the world's 10 largest economies by purchasing power parity—there is still room for more progress.

In 2013, the Pew Research Center surveyed nearly 40,000 people in 39 countries and asked the question: Will children in your country be better off than their parents? Interestingly, in most of the advanced economies, the answer to the question was overwhelmingly 'no.' Two-thirds of people surveyed in the United States answered that way, and the people in Britain weren't much more optimistic their children would be better off than them, either.

In contrast, in China, 82% of those surveyed expected their children to do better, and in Brazil, 79% felt that way. In Chile, Malaysia, Venezuela, Indonesia, the Philippines, Nigeria, Ghana and Kenya, the majority of people surveyed also believed that the next generation will be better off than the current one.

A Changing Profile

Not only have consumers changed, the profile of what one might think of as an emerging-market company has as well. In the past, these businesses were generally fairly simple, nascent business models. They were highly geared towards infrastructure.

During the last 10 years or so, we've seen a gradual migration to increasingly sophisticated business models. Emerging-market companies have established their own brand names, their own niches and have expanded beyond their home countries or region, often by acquisition.

We are seeing a new generation of emerging-market companies develop. By and large, emerging-market companies have also seen healthy cash-flow generation and improving earnings. In the past, there were certain periods where corporate balance sheets were under severe stress due to foreign-exchange debt. They ran into problems, particularly when the local currency came under pressure.

Today, these currency issues seem to be managed much better and corporate balance sheets appear to be much healthier. In general, emerging-market companies have deleveraged over time; they have cleaned up their balance sheets and repaired their business models.

It's Still about Growth

One characteristic that has generally defined emerging markets in the past—and still does—is their high growth rate. Emerging-market economies have been growing significantly faster than developed-market economies, and we anticipate this trend should likely continue.

Despite this higher rate of growth, valuations generally appear much more reasonable than in developed markets. You can invest in many of these companies at a price that is a significant discount to what you would have to pay to invest in an equivalent business in the developed world.

Business models in emerging markets have become far more sophisticated and robust than they ever were in the past. We are very excited about the opportunities we're finding in emerging markets today and the potential for the future.

Carlos Hardenberg's comments, opinions and analyses are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and

1, -

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment