Australia holds interest rate at record low

The economy's bumpy transition away from resource-based growth after an unprecedented surge in mining investment has been hurt by a slowdown in China, its largest trading partner, and plunging commodity prices.

While GDP expanded by a better-than-expected 3.0 percent last year, the recent buoyancy in the housing market which has helped to support growth has softened, while consumer sentiment is weakening.

The Reserve Bank of Australia warned that the climbing Australian dollar, a commodity-linked currency, would jeopardise the economy's transition. Exports from non-resources sectors as well as services industries would be hurt by an increasing exchange rate.

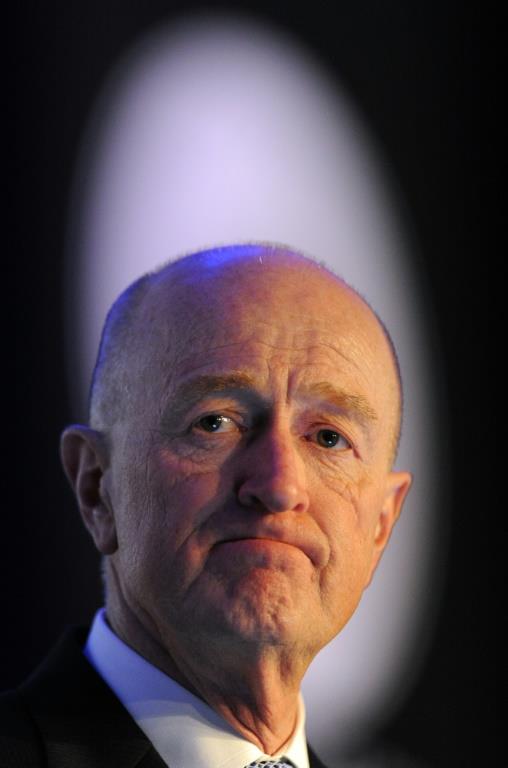

"The Australian dollar has appreciated somewhat recently," RBA governor Glenn Stevens said in a statement after the monthly board meeting, acknowledging the recent rise in commodity prices and easing moves by other central banks.

"Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy."

The local unit went from 75.84 US cents to 76.23 US cents after the statement, reflecting investors' disappointment that Stevens did not use stronger language to try to talk down the dollar. At the last monthly meeting on March 1, it traded around 71.40 US cents.

"The key takeaway for me is that they've made it clear that they don't want a stronger currency," National Australia Bank's co-head of FX strategy Ray Attrill told AFP.

"It arguably implies 'we don't like it but there's not much we can do about it'."

The central bank also highlighted the global low inflation environment and said consumer prices in Australia are "likely to remain low over the next year or two".

"Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand," Stevens said.

Analysts said while the consumer price index -- which has been below the RBA's target band of two to three percent for several months -- was likely to increase in the first quarter of this year, further currency rises could soften inflation.

"If the Aussie dollar strength continues through (the second-quarter), CPI will weaken providing a case for a potential cut in (the second half)," IG Markets' Angus Nicholson said in a note.

The Reserve Bank has slashed rates by 275 basis points since November 2011 to boost the economy, but it has been almost a year since its last cut in May 2015.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment