(MENAFN- ProactiveInvestors)

If you want to know what happened in 2014 with regard to gold and oil it’s important to appreciate the inverse relationship between the U.S. dollar and commodities. The following chart is a good place to start:

click to enlarge

Whereas total returns for the S&P 500 Index and 10-Year Treasury bond stayed relatively stable throughout the year commodities and the U.S. dollar both made an incredible about-face starting around late June early July. If you don’t factor in China’s renminbi using purchasing power parity the dollar is the world’s strongest currency. As I’ve written about on multiple occasions this has weighed heavily on the commodities we track very closely and report on here at U.S. Global Investors especially gold and crude oil.

According to BullionVault in fact 2014 was the worst year for commodities since 1986 when they gave back 8.85 percent.

That being said let’s open up the Frank Talk archives and look back at the most important commodity stories of 2014.

Oil Dropped Nearly 50 Percent Since the Summer

It should come as no surprise that oil dominated the news in the second half of the year. Since its peak in June when West Texas Intermediate (WTI) crude was priced at around $105 per barrel oil has tumbled nearly 50 percent to settle in the mid-$50s. We haven’t seen a decline such as this since the financial collapse of 2008 and 2009.

So how did prices get here How did they fall so steeply so unexpectedly

It’s been a perfect storm to be sure. For one the U.S. shale boom has brought about what some call an oil glut in the market. The Saudis have resisted oil production curbs with the intention of undercutting the world’s competition namely the U.S. Russia and fellow members of the Organization of the Petroleum Exporting Countries (OPEC).

Global growth and the Purchasing Manager’s Index (PMI) are also cooling leading to tepid demand for oil. As I’ve mentioned on numerous occasions when the one-month moving average for the global PMI falls below the three-month moving average WTI crude has fallen 100 percent of the time six months later. Though past performance can’t predict future results history illustrates a convincing trend.

click to enlarge

And finally there’s the strong dollar which has historically put pressure on commodities most notably crude.

click to enlarge

Granted battered oil prices have led to cheap gasoline giving consumers all around the globe a welcome tax break this holiday season—a $330 billion tax break to be exact.

But many oil companies involved in hydraulic fracturing which is a pricier process than more conventional drilling methods are starting to feel the pinch. Several companies have already been forced to temporarily close rigs in pricier shale regions including the Eagle Ford in Texas and Bakken in North Dakota.

As calamitous as this might appear there are still investment opportunities aplenty. In this recent Frank Talk I took a contrarian view arguing that because oil stocks are currently priced so reasonably now might be the time to pick up some exposure to this space. As I wrote:

For far too many investors by the time they gain back the confidence to put money into oil stocks again the rally might have already taken off making it challenging to capture the full benefit of the upswing.

And there’s reason to believe that prices will normalize sooner rather than later. Brian Hicks portfolio manager of the Global Resources Fund (PSPFX) stated that “oil prices are below where they should be and hopefully they’ll start gravitating back to the equilibrium price of between $80 and $85 a barrel.”

Gold Found the Support Where Oil Didn’t Was the Second-Best Currency of the Year

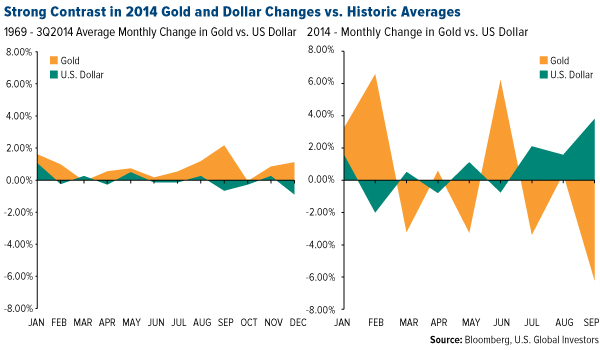

Like oil gold was punished in the second half of the year because of the strong dollar. In the following chart from an October Frank Talk you can see just how much of an impact the greenback has had on the yellow metal this year alone:

click to enlarge

In this Frank Talk posted in June I wrote:

There is always an emotional bias against gold whether it is soaring high or dipping low and that is why it’s important to manage these emotions when positioning a portfolio. At U.S. Global Investors we look objectively at the action of both gold stocks and gold bullion by monitoring these long-term data points and paying attention to buy and sell signals based on the trend of mean reversion.

This of course was back when gold bullion was priced at above $1300. Since then it’s slipped nearly 10 percent which might have discouraged some gold bugs.

But according to a recent article from Hard Asset Investor gold was actually the second-best-performing currency of the year second only to the U.S. dollar:

Given the strength of the dollar it’s surprising that gold has held up as well as it has. At current prices gold is only down 2 percent year-to-date which is actually the best performance of any of the major non-fixed currencies.

click to enlarge

Before gold and other commodities began to slump they were actually performing very well as I mentioned at the beginning of the piece. Back in July this is what it looked like when you compared gold spot prices and the NYSE Arca Gold BUGS Index:

click to enlarge

For the first time in two years gold mining stocks were beating bullion which was good news for both the commodity and equities. When miners do well gold has tended to follow suit.

But then in mid-summer prices began to fizzle. When you chart the two asset classes for the remainder of the year this is what you get:

click to enlarge

The problem is that when spot prices are between $1000 and $1200 an ounce—which is now the case—it’s challenging for miners to break even in terms of cash flow. Gold royalty companies however continue to impress. has returned 39 percent year-to-date while has delivered 22 percent.

According to Ralph Aldis portfolio manager of the Gold and Precious Metals Fund (USERX) and World Precious Metals Fund (UNWPX):

Much of the gold mining industry is underwater and can’t make money with these prices. We’ve seen capital programs being significantly cut back in terms of companies looking to expand and build new mines. That’s all been put on hold. Those companies have been sufficiently scared enough that even when gold prices do recover they’re going to hold off on expansions because they might have lost the appetite to risk capital on new projects.

But on a positive note “Because of this we might see prices firm up and companies will be rewarded.”

As always we recommend a 10-percent weighting in gold: 5 percent in bullion another 5 percent in gold stocks. Then rebalance every year.

In a Time When Many Commodities Were Depressed Diamonds Retained Their Glitter

I spend a lot of time writing and speaking about gold and more recently oil. But another commodity that we at U.S. Global Investors care about is diamonds. After all the U.S. is the world’s largest diamond market responsible for half of the world’s $72 billion in sales made annually.

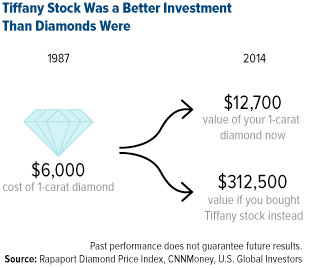

We hold luxury retailer in our Gold and Precious Metals Fund (USERX). Although physical diamonds are a sound investment diamond stocks can be even more of a prudent buy.

We hold luxury retailer in our Gold and Precious Metals Fund (USERX). Although physical diamonds are a sound investment diamond stocks can be even more of a prudent buy.

As you can see to the right a $6000 diamond purchased in 1987 would now be worth double that. But $6000 in Tiffany stock purchased at the same time Yeah that would have returned 5108 percent.

So guys think about that next time you’re picking out a diamond ring or necklace for your significant other. Which do you think she might appreciate more

In Frank Talk from August I discuss diamond exploration and mining company Lucara Diamond held in both USERX and our World and Precious Minerals Fund (UNWPX). Lucara continues to be an attractive asset returning 18.5 percent year-to-date. Since June it has been paying dividends.

South African Labor Strike Brought and Palladium into the Headlines

Back in June a five-month labor strike in South Africa the country’s longest was seriously threatening the world supply of and palladium used predominantly in the production of catalytic converters. The African country is responsible for 37 percent of the world’s palladium 78 percent of the world’s with Russia largely taking up the rest of the slack. Every day the strike dragged on thousands upon thousands of both group metals were being lost.

Because of the strike and supply concerns prices of the precious metals surged to $1500 an ounce and palladium to $850 an ounce.

The conditions of the strike were finally resolved by the end of June—and not a moment too soon as reserves were beginning to run dry. Since then prices have stabilized. is now just above $1200 palladium around $815.

Solar Energy Will Increasingly Drive Silver Demand

Tom Werner president and CEO of solar panel-maker believes that solar energy could be a $5 trillion industry within the next 20 years. It’s easy to see why he feels this way as demand forphotovoltaic (PV) installation ticks up every year.

click to enlarge

This news bodes well for silver between 15 and 20 grams of which is used in every solar panel manufactured. In fact for the first time in over a hundred years silver fabrication demand in photography has been outpaced by this new-ish burgeoning technology.

Once a pie-in-the-sky idea solar has finally emerged as a viable near-mainstream source of energy that will increasingly play a crucial role in powering residences businesses and factories. Some of the nation’s largest companies including Walmart and Ford already depend heavily on solar to power many of their facilities.

And with solar installation prices falling all the time—year-over-year they’ve declined around 9 percent—more and more businesses and homeowners will join them which should support silver demand.

Good Times Bad Times

As I write in my whitepaper “Managing Expectations”:

A keen awareness of the ebbs and flows of historical and socioeconomic conditions on both the macro and micro scales allows our investment management strategy to be more proactive than reactive.

Everything operates in cycles including the weather gold seasonal trends four-year election terms and more. The domestic and global markets are no different. Commodities might be down this year but as recently as 2009 and 2010 they were the best-performing asset class.

According to our Periodic Table of Commodities Returns a perennial favorite among Frank Talk and Investor Alert readers oil was the second-best performer just last year returning 7.19 percent while gold had its worst year since 1981. Such is the nature of investing. Every asset class as I often say has its own DNA of volatility.

click to enlarge

Speaking of the Periodic Table we will be sharing the eagerly-awaited commodities returns for 2014 early next year. Subscribers to our Investor Alert will be first to see them so be sure to subscribe if you haven’t already done so.

I wish you all a safe and prosperous 2015! A perfect New Year’s Resolution is to supplement your retirement income with investment-grade municipal bonds which you can accomplish through our Near-Term Tax Free Fund (NEARX). Read my latest story “A Little Pillow Talk Turned Her Husband on to Bonds” to learn more!

Please consider carefully a fund’s investment objectives risks charges and expenses. For this and other important information obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage Inc.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.