(MENAFN- DailyFX) DailyFX.com - r>

Talking Points:

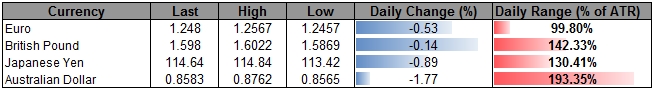

- EUR/USD to Face Larger Rebound Should ECB Attempt to Buy More Time

- AUD/USD Searches for Support Ahead of Australia Employment Report.

- USDOLLAR RSI Threatens Overbought Territory; ADP & ISM Non-Manufacturing Bodes Well for NFP.

For more updates sign up for David's e-mail distribution list.

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

-

EUR/USD looks poised to hold the tight range ahead of the European Central Bank (ECB) interest rate decision even as the Governing Council is widely expected to sound increasingly dovish in November.

-

However we may see a relief rally in EUR/USD should the ECB make an attempt to buy more time and merely reiterate the statement from the October 2 meeting.

-

The DailyFX Speculative Sentiment Index (SSI) shows a recent flip in position as the retail crowd is now net-long EUR/USD with the ratio currently standing at +1.17.

AUD/USD

-

Downside targets remain favored for AUD/USD as the long-term bearish momentum in the Relative Strength Index (RSI) continues to take shape while the Reserve Bank of Australia (RBA) retains the verbal intervention.

-

Even though Australia’s Employment report is expected to show a 20.0K rebound in job growth market participants may show a limited reaction amid the change in methodology.

-

As the AUD/USD continues to search for a lower-low next level of interest comes in around 0.8510 (50.0% expansion) to 0.8525 (50.0% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Waiting On USD/CHF

Crude Oil Testing Key Level Ahead Of US Inventories Data

USDOLLAR(Ticker: USDollar):

|

" style="text-align:center">

Index

|

" style="text-align:center">

Last

|

" style="text-align:center">

High

|

" style="text-align:center">

Low

|

" style="text-align:center">

Daily Change (%)

|

" style="text-align:center">

Daily Range (% of ATR)

|

|

DJ-FXCM Dollar Index

|

" style="text-align:center">

11234.39

|

" style="text-align:center">

11248.52

|

" style="text-align:center">

11155.36

|

" style="text-align:center">

0.62

|

" style="text-align:center">

145.50%

|

Chart - Created Using FXCM Marketscope 2.0

-

Dow Jones-FXCM U.S. Dollar Index rallies to a fresh high of 11248 but there appears to be an RSI divergence taking shape as the oscillator struggles to push back into overbought territory.

-

Even though the ISM Non-Manufacturing index fell short of market expectations the employment component showed a faster rate of job growth in service-based sectors which certainly raises the scope of seeing a better-than-expected Non-Farm Payrolls (NFP) report.

-

With the topside push the next topside objective for USDOLLAR comes in around 11308 (50.0% expansion) -11312 (78.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release

|

" style="text-align:center">

GMT

|

" style="text-align:center">

Expected

|

" style="text-align:center">

Actual

|

|

MBA Mortgage Applications (OCT 31)

|

" style="text-align:center">

12:00

|

" style="text-align:center">

--

|

" style="text-align:center">

-2.6%

|

|

ADP Employment Change (OCT)

|

" style="text-align:center">

13:15

|

" style="text-align:center">

220K

|

" style="text-align:center">

230K

|

|

Markit Purchasing Manager Index- Services (OCT F)

|

" style="text-align:center">

14:45

|

" style="text-align:center">

57.1

|

" style="text-align:center">

57.1

|

|

Markit Purchasing Manager Index- Composite (OCT F)

|

" style="text-align:center">

14:45

|

" style="text-align:center">

--

|

" style="text-align:center">

57.2

|

|

ISM Non-Manufacturing Index (OCT)

|

" style="text-align:center">

15:00

|

" style="text-align:center">

58.0

|

" style="text-align:center">

57.1

|

Click Here for the DailyFX Calendar

--- Written by David Song Currency Analyst

To contact David e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE Check out Mirror Trader.

New to FX Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source