(MENAFN- DailyFX) DailyFX.com -

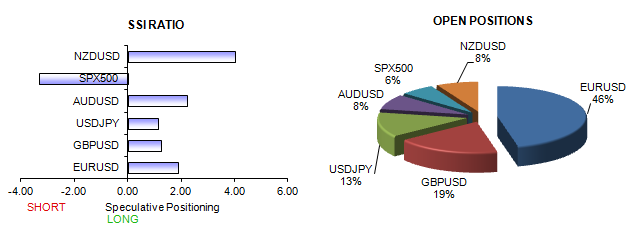

- Dollar likely to continue to fresh highs on major shifts in forex sentiment

- Japanese Yen, Euro, and Sterling look at particular risk of losses

- Keep an eye at Commodity Bloc at these levels

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

EURUSD - Euro Positions at Record, Further Losses Seem Likely

GBPUSD - British Pound Breakdown Confirmed, Look for Losses

USDJPY - Key Factors Favor a Much Larger USDJPY Breakout

AUDUSD - Australian Dollar Poised for Further Losses

SPX500 - Need to See a Larger Move to Confirm S&P 500 Top

NZDUSD - New Zealand Dollar at Clear Risk of Further Losses

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

Record positions in the US Dollar warn that we’re at a substantial turning point, but until this changes we’ll remain in favor of buying USD at these levels.

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

Automate our SSI-based trading strategies via Mirror Trader free of charge

-- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

original source

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.